Financial Feud

service design · finance · mobile app

How can banks help improve teenagers' financial literacy?

Challenge

Outcome

More than 20% of United States teenage students lack basic financial literacy skills. In a world full of digital and global financial activity, the potential for financial scams, and the upcoming long-term life decisions involving money, this lack of knowledge can be damaging. Because of this, PNC Bank wanted us to design a service that can help improve teenagers' financial literacy.

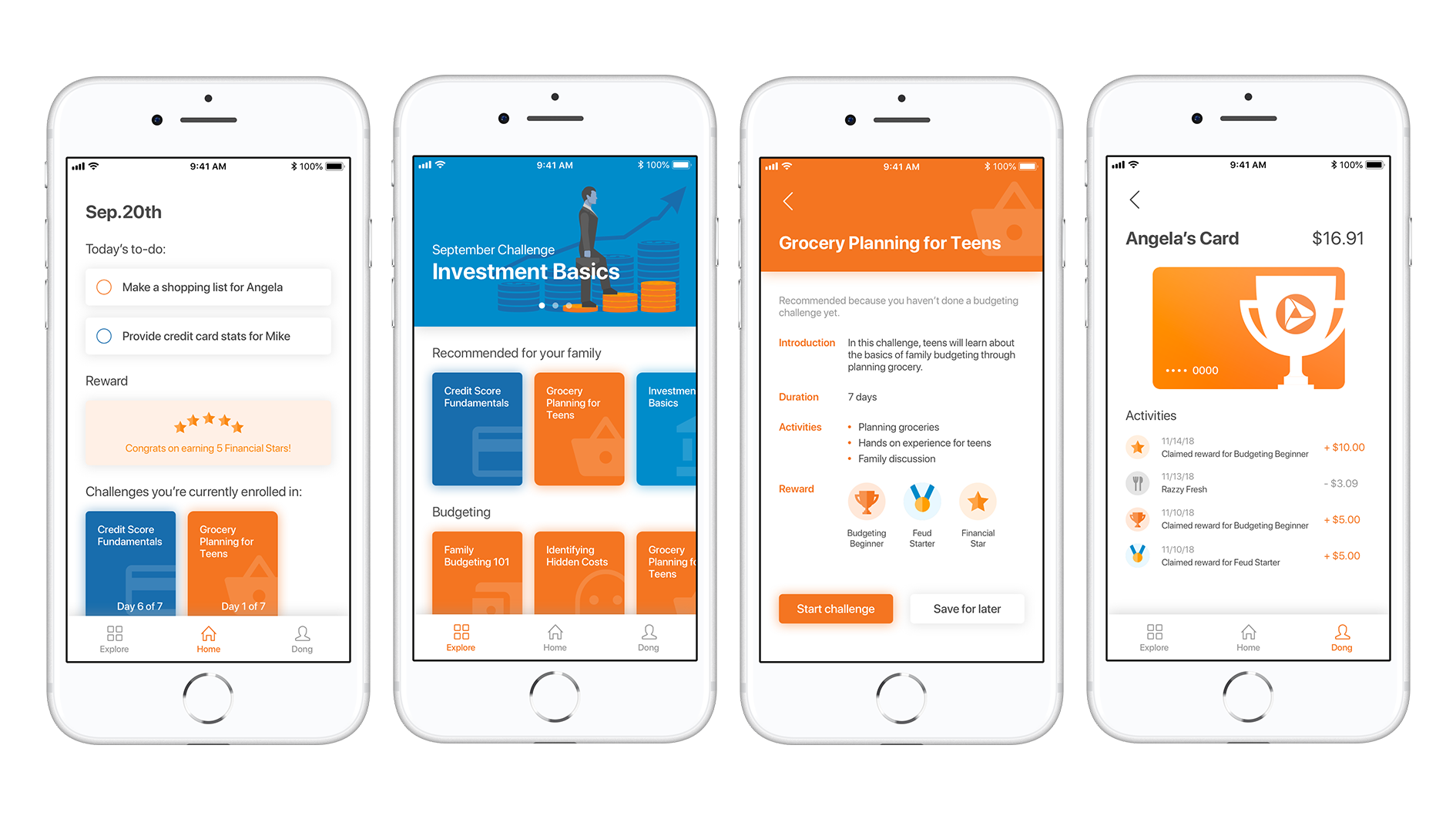

My team and I designed a service that provides families with weekly financial challenges which encourages teens to build basic financial skills with their family together, while building a relationship with PNC.

Role

Teammates

My teammates and I worked together on research and ideation. Individually, I was responsible for prototyping the mobile application and making mock-ups.

Aishwarya Dwivedi, Tiffany Lai, Xuejiao Liu, Reva Pabba

Design Overview

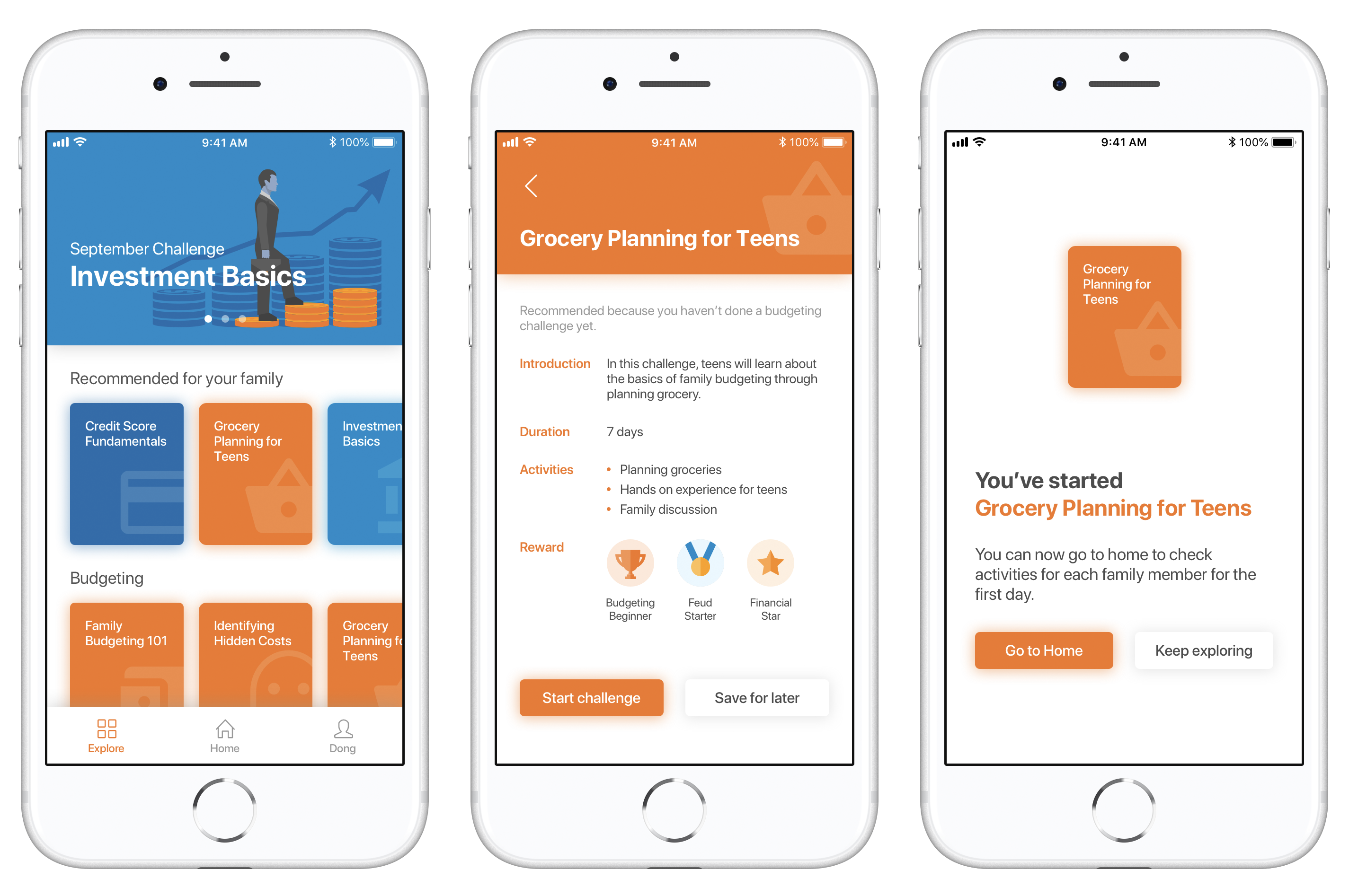

The mobile application analyzes a family's data and recommends financial challenges that are tailored to the family.

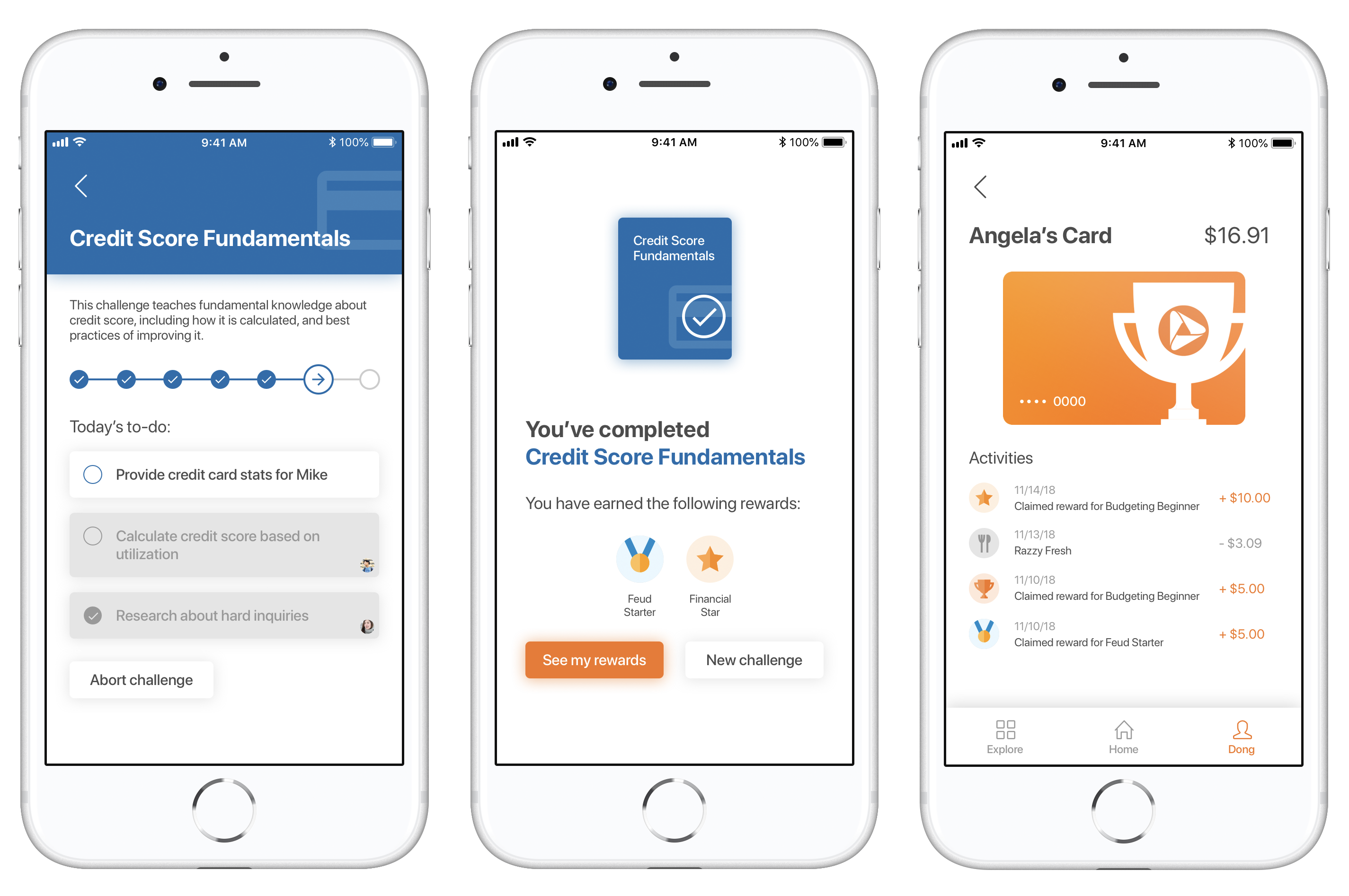

Teenagers complete tasks with other family member and learn financial knowledge through first-hand activities.

Teenagers get rewards upon finishing a challenge, which can be turned into discount coupons or monetary prizes for them to use.

Design Process

Generative Research

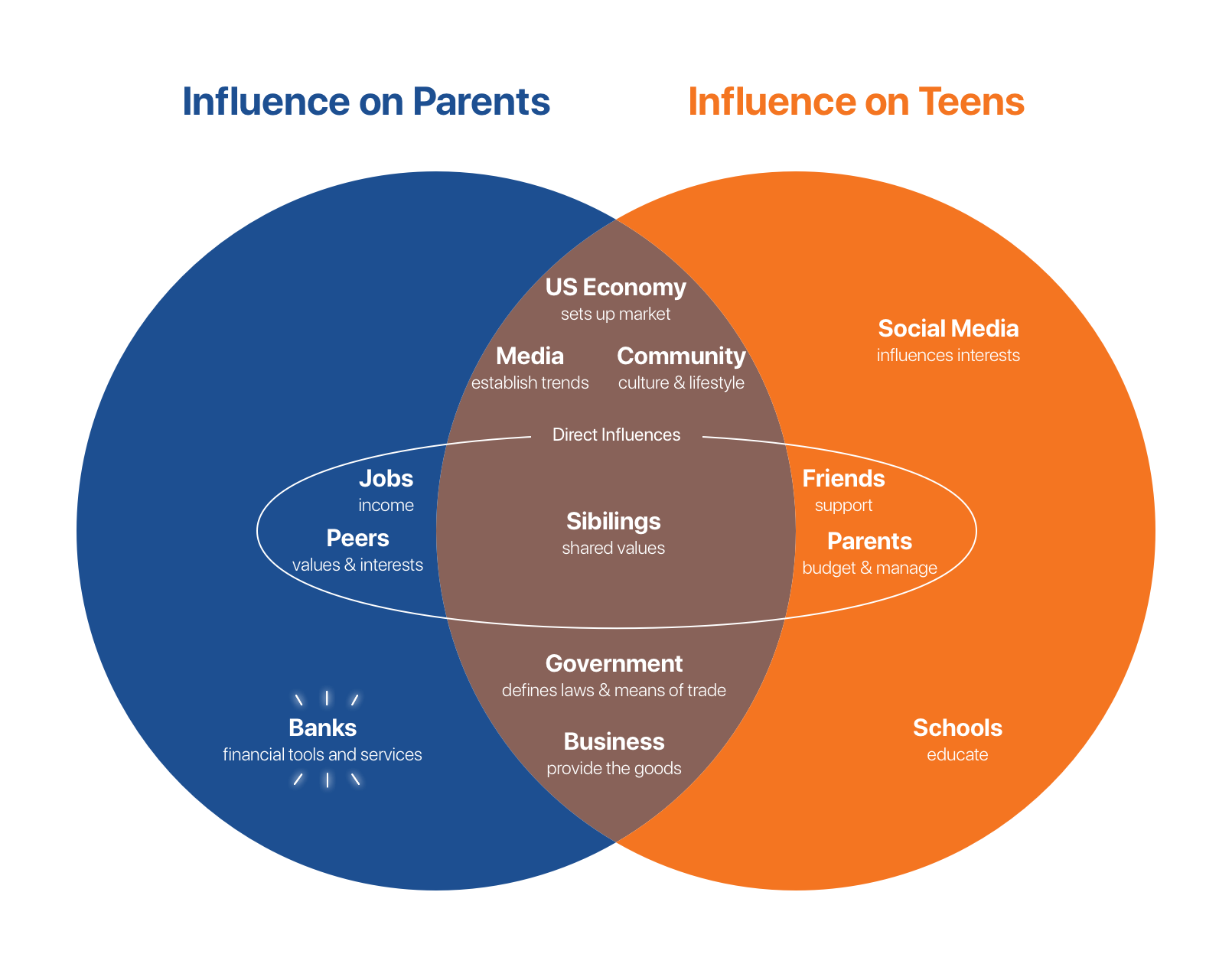

Stakeholder analysis

We brainstormed influences on teenagers in terms of financial activities.

We also considered influences on parents because they are closely related to teens.

From the analysis, we found that Banks only influences the parents but not the teenagers.

This led us to move research direction towards exploring the parent-teen relationship in terms of finance, because PNC needs to engage with teenagers through parents.

Interviews

We interviewed representatives from PNC Bank about their resources and their vision of promising directions.

Literature reviews

We reviewed 10 papers with topics including the current state of financial literacy among teenagers and evaluation of financial education programs.

Competitive analysis

We analyzed 7 products on the market with purposes to improve financial literacy among teenagers (Bank of America, ThreeJars, etc.).

Online surveys

We set up two surveys online:

- for young students in college, about their financial behavior

- for parents, about their involvement in their children's financial education

Survey for students

Survey for parents

Literature source

Literature source

Competitive analysis - BoA

Competitive analysis - Cashcourse

6 / 6

<

>

Key findings

Finance can be a community/family topic.

Managing finances is usually initiated by a trigger.

Successful applications maintain engagement with people by giving continuous, immediate, and unambiguous feedback.

Programs promoting financial literacy should be tailored to an individual’s knowledge, ability, demographics, life stage, and learning styles.

Problem Framing

Problem statement

Opportunity area

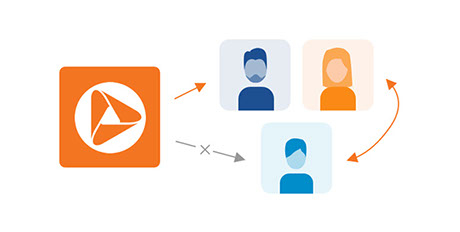

PNC bank does not have a direct engagement with teenagers, so they can't influence their financial literacy.

PNC can leverage the parent-teen relationship and provide a personalized financial service to the whole family with continuous trigger.

Ideation

Personae

We started ideating how to solve the problem by creating three personae representing different family members.

Judy - mom of a teen in high school

Maria - a college freshman

Justin - a high school teenager

Needs

Needs

Needs

- To impart financial knowledge to her son

- To be better at finance herself

Pain point

- To learn about how to pay off her student loans

- To use her earnings more wisely

Pain point

- To learn how to spend his allowance better

- To save up money for his parents' wedding anniversary

Has little time to invest in her son's life

Has a busy schedule with college and work

Pain point

Spends too much when he goes out with friends

Brainstorming and speed-dating

Around these personae, we brainstormed 30+ ideas about how PNC can solve their need. We then created storyboards for top 5 idea (see appendix), and tested these ideas with teens and parents through speed-dating sessions.

Findings from speed-dating

- Idea of an application that presents financial challenges for families to complete received the most positive reactions

- Need to reduce timespan of the challenges

- Need a reward system that would drive engagement

Solution

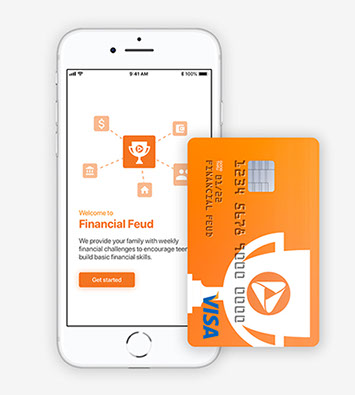

The solution is Financial Feud:

- a service utilizing mobile application

- provides families with weekly financial challenges

- creates opportunities for teenagers to learn financial knowledge through first-hand activities

- rewards are given that can be turned into monetary prizes

Various challenges to choose from

Financial Feud has financial challenges in categories such as budgeting, investment, credit, etc. to help people achieve various financial goals.

Maria chooses the challenges related to student loans to learn about how to pay them off more efficiently.

Justin's parents help him choose the challenges in the "budgeting" category so that he can learn about budgeting his allowance.

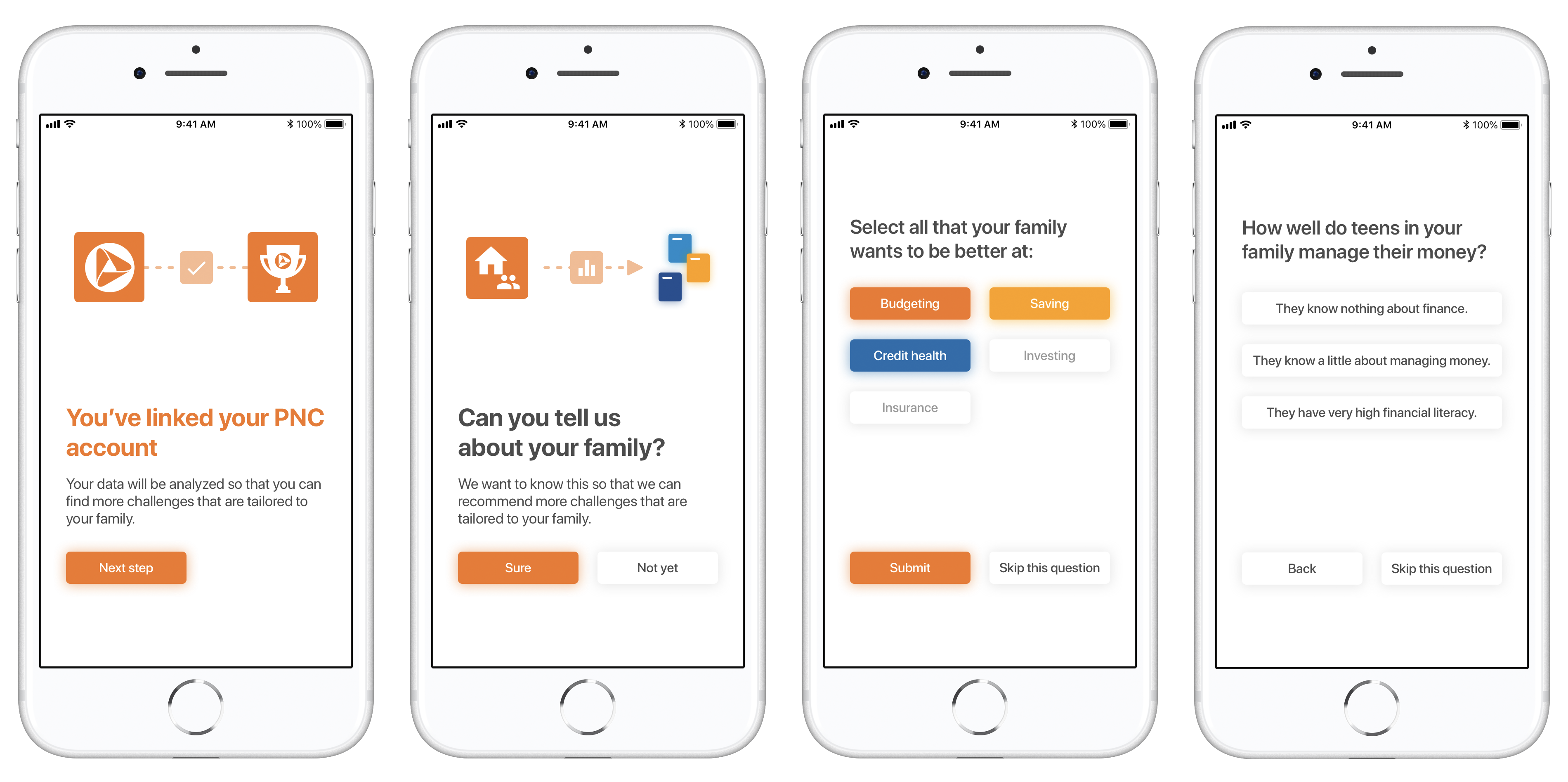

Challenges tailored to each family

Upon permission, Financial Feud can uses data provided by the family or from their bank accounts to recommend challenges that best suit the family.

With data of Judy's family savings, investment challenges are recommended to her to help her family learn to utilize the savings better.

Based on Maria's financial history, she is recommended credit challenges to help her build a better credit profile.

Reward system

Financial Feud gives family rewards upon finishing challenges. These rewards can be redeemed for monetary prizes or coupons. Families can apply for a card which allows the teenagers to use these prizes directly.

Justin is incentivised by the reward system and completes challenges with great motivations.

Judy can see how her son is using the rewards without the worry if he is making bad purchasing decisions.

Value model

This service creates value for not only the families but also PNC as well.

Appendix

Feel free to download the presentation poster and also the process book.

Storyboards for speed-dating

4 / 4

<

>

Service blueprint

·

·

·

·

·

·

Resume

© 2021 Mike Dong